1 Million Interest-Free Loan

The Asaan Karobar Card Scheme, introduced by the Punjab government, is a groundbreaking initiative aimed at empowering small business owners by providing interest-free loans of up to 1 million PKR. This scheme is designed to help entrepreneurs in Punjab expand their businesses, manage operational costs, and achieve financial stability. With flexible repayment terms and digital management features, this program is a game-changer for small businesses in the province.

More Read:CM Punjab Asaan Karobar Finance Loan Scheme

Let’s delve into the details of this scheme, including eligibility criteria, application methods, repayment structure, and benefits.

Quick Overview of the Asaan Karobar Card Scheme

| Field | Details |

|---|---|

| Name of the Program | Asaan Karobar Card Scheme |

| Start Date | January 2025 |

| End Date | Ongoing |

| Amount of Assistance | Up to 1 million PKR (interest-free loan) |

| Method of Application | Online and Offline (via Bank of Punjab branches) |

Overview of the Asaan Karobar Card

The Asaan Karobar Card Scheme,Will Provide 1 Million Interest-Free Loan spearheaded by CM Punjab Maryam Nawaz, aims to support entrepreneurs with interest-free loans. With a maximum loan amount of 1 million PKR, this initiative seeks to remove financial hurdles faced by small businesses. Entrepreneurs can use the loan to cover various expenses such as inventory procurement, utility bills, supplier payments, and more.

A notable feature of the program is the digital platform that ensures easy access, transparent tracking, and efficient loan management. The scheme also provides flexible repayment terms with a grace period of three months, followed by manageable monthly installments.

Features of the CM Punjab Asaan Karobar Card

The following features make this scheme highly beneficial for small business owners:

- Loan Amount: Interest-free loans of up to 1 million PKR.

- Revolving Credit: Access funds as needed within a 12-month period.

- Repayment Flexibility: A 3-month grace period and 24 equal monthly installments for repayment.

- Digital Platform: Supports digital payments via POS systems and mobile apps.

- Cash Withdrawal: Entrepreneurs can withdraw up to 25% of the loan amount in cash.

- Comprehensive Usage: Funds can be used for supplier payments, taxes, bills, and other operational costs.

More Read:CM Asaan Karobar Finance Scheme

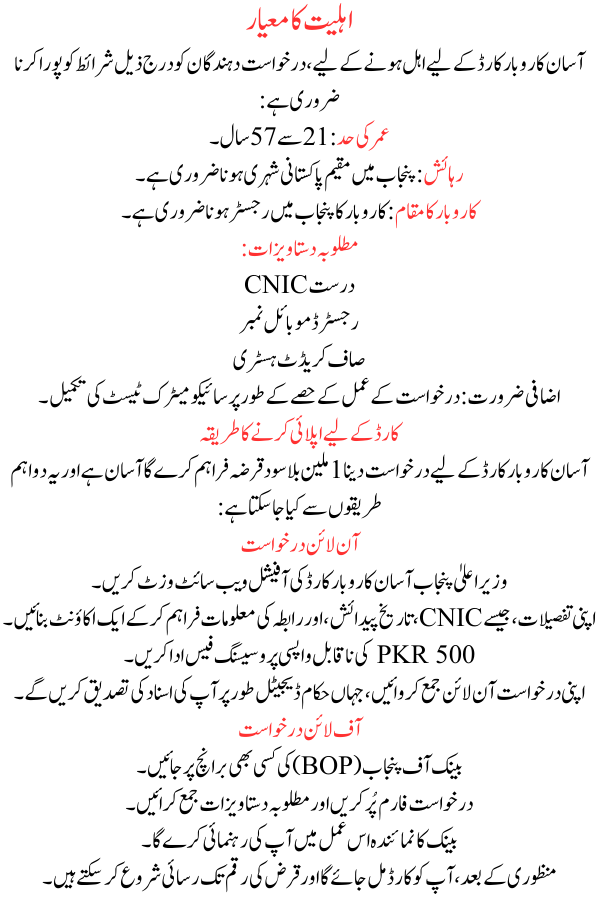

Eligibility Criteria

To qualify for the Asaan Karobar Card, applicants must meet the following conditions:

- Age Limit: 21 to 57 years old.

- Residency: Must be a Pakistani national residing in Punjab.

- Business Location: The business must be registered in Punjab.

- Documents Required:

- Valid CNIC

- Registered mobile number

- Clean credit history

- Additional Requirement: Completion of a psychometric test as part of the application process.

How to Apply for the Card

Applying for the Asaan Karobar Card Will Provide 1 Million Interest-Free Loan is simple and can be done through two main methods:

Online Application

- Visit the official CM Punjab Asaan Karobar Card website.

- Create an account by providing your details, such as CNIC, date of birth, and contact information.

- Pay the non-refundable processing fee of 500 PKR.

- Submit your application online, where authorities will verify your credentials digitally.

Offline Application

- Visit any branch of the Bank of Punjab (BOP).

- Fill out the application form and submit required documents.

- The bank representative will guide you through the process.

Once approved, you will receive the card and can start accessing the loan amount.

More Read:How to Apply for Zero-Interest Loans

Loan Usage and Repayment Details

- Loan Usage:

- 50% of the loan is accessible immediately.

- The remaining 50% is unlocked after successful use of the initial amount and timely repayments.

- Grace Period: Borrowers get a 3-month grace period before repayments begin.

- Repayment Structure:

- Repayment in 24 equal monthly installments.

- Minimum monthly payment: 5% of the outstanding balance.

- Conditions: Funds must be used strictly for business-related expenses.

Charges and Fees

Although the loans are interest-free, some charges apply:

- Annual Fee: 25,000 PKR plus Federal Excise Duty (FED).

- Processing Fee: 500 PKR (non-refundable).

- Late Payment Charges: Applicable as per bank policy.

Security and Key Conditions

To ensure responsible use, the following conditions are enforced:

- Personal Guarantee: Borrowers must sign a digital guarantee.

- Life Assurance: Included for financial security in case of unforeseen events.

- Business Verification: Physical verification of business premises within 6 months.

- Tax Registration: Must register with PRA or FBR within 6 months of receiving the loan.

More ReadAsaan Karobar Finance Register

Benefits of the Scheme

The Asaan Karobar Card Scheme offers numerous advantages:

- Zero Interest: An affordable and risk-free financial solution for entrepreneurs.

- Flexible Repayments: Convenient repayment options to ease financial stress.

- Digital Convenience: Manage loans and transactions easily through the platform.

- Business Growth: Use funds for essential expenses, ensuring smooth business operations.

Conclusion

The CM Punjab Asaan Karobar Card Scheme Will Provide 1 Million Interest-Free Loan is a revolutionary initiative that addresses the financial challenges faced by small business owners in Punjab. By offering interest-free loans, easy application procedures, and flexible repayment options, this scheme empowers entrepreneurs to achieve financial independence and business growth.