Karobar Card Loan Scheme for Small Businesses

The Punjab Government has announced the Karobar Card Loan Scheme and the Chief Minister Asan Karobar Financing Scheme to support small and medium-sized trades in the province. These wits aim to empower tycoons, reduce unemployment, and boost economic growth by offering interest-free loans reaching from Rs. 100,000 to Rs. 3 million. Below is a complete guide to these schemes, their objectives, application courses, eligibility criteria, and likely impact.

More Read:Punjab Kisan Card Distribution 2025 Scheme

What is the Karobar Card Advance Scheme?

The Karobar Card Loan Scheme for Small Businesses is an initiative designed to provide interest-free loans to small business owners. The main skins of the scheme include:

- Loans ranging from Rs. 100,000 to Rs. 1 million for small businesses.

- Recipients repay loans through easy installments.

- Promotes self-employment and economic stability for youth in Punjab.

The scheme is completed by the Chief Minister Asan Karobar Financing Scheme, which provides loans of up to Rs. 3 million for medium-sized trades, allowing them to expand their operations and contribute to the cheap.

Objectives of the Loan Schemes

The primary goals of these initiatives are:

- Promoting entrepreneurship: Encouraging persons to start or expand trades.

- Reducing unemployment: Creating job chances for youth.

- Stimulating economic growth: Enhancing economic stability and productivity.

- Empowering individuals: If financial capitals to foster autonomy.

These schemes aim to found a thriving business culture in Punjab by removing financial barriers for wishful entrepreneurs.

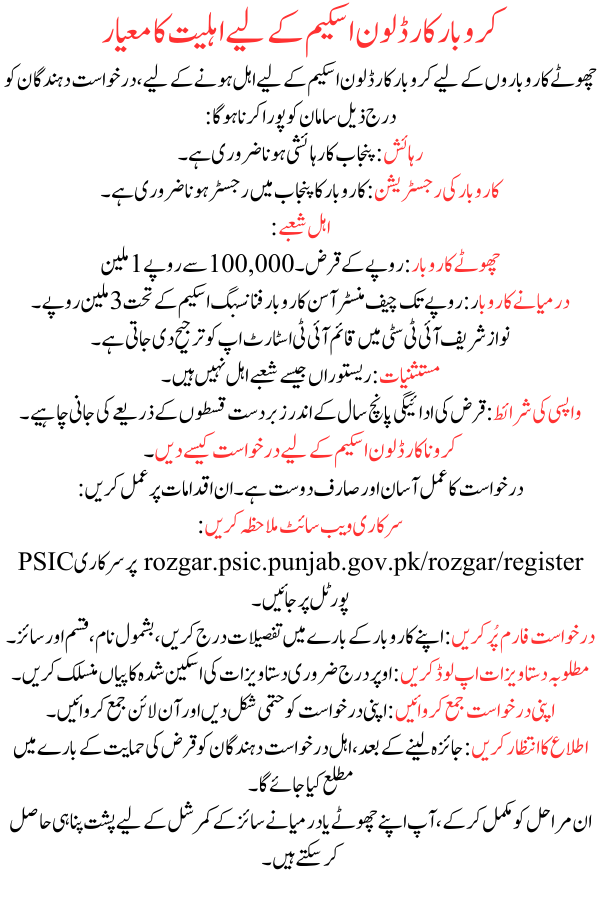

Eligibility Criteria for the Karobar Card Loan Scheme

To qualify for the Karobar Card Loan scheme for Small Businesses, applicants must meet the following supplies:

More Read:BISP Kafalat Program Double Payment Verification

- Residency: Must be a resident of Punjab.

- Business Registration: The business must be registered in Punjab.

- Eligible Sectors:

- Small businesses: Loans of Rs. 100,000 to Rs. 1 million.

- Medium businesses: Up to Rs. 3 million under the Chief Minister Asan Karobar Financing Scheme.

- IT startups based in Nawaz Sharif IT City are prioritized.

- Exclusions: Sectors such as restaurants are not eligible.

- Repayment Terms: Loans must be paid within five years through wieldy installments.

Documents Required for the Application

To apply for the Karobar Card Loan Scheme for Small Businesses , the following documents are essential:

- CNIC: Valid computerized national identity card.

- Proof of Residence: Utility bills, rent agreement, or domicile.

- Business Registration Certificate: Proof of registered business in Punjab.

- Business Plan: Detailed plan outlining loan usage and goals.

- Bank Statements: Last six months’ deal history.

- Income Proof: Existing income or revenue documentation.

- Application Form: Completed and signed form.

- Photographs: Recent passport-sized photographs.

- Guarantee Documents: Guarantor’s CNIC and monetary details (if required).

- Tax Documents: NTN or tax filing proof (if applicable).

More Read:Honhaar Scholarship Program 2025

How to Apply for the Karobar Card Loan Scheme

The application process is simple and user-friendly. Follow these steps:

- Visit the Official Website: Go to the official PSIC portal at rozgar.psic.punjab.gov.pk/rozgar/register.

- Fill Out the Application Form: Enter details about your business, including name, type, and size.

- Upload Required Documents: Attach scanned copies of the essential documents listed above.

- Submit Your Application: Finalize and submit your application online.

- Await Notification: After review, eligible applicants will be notified of loan support.

By completing these steps, you can secure backing for your small or medium-sized commercial.

Loan Distribution and Repayment Process

Approved loans will be spread based on the size and type of the business:

- Small businesses: Loans between Rs. 100,000 and Rs. 1 million.

- Medium enterprises: Loans up to Rs. 3 million.

Payments are structured into manageable installments, ensuring trifling monetary strain on borrowers. The interest-free nature of the loans allows trades to grow without added financial burden.

Top Tips for Starting a Business in Punjab

Here are some applied tips to make the most of the Karobar Card Loan Scheme for Small Businesses:

- Develop a Strong Business Plan: Clearly outline your business goals and how you intend to use the loan.

- Research Your Market: Understand your target spectators and competitors.

- Keep Records Updated: Ensure all required documents are accurate and up-to-date.

- Utilize Government Resources: Leverage free exercise and support programs offered by the Punjab Government.

- Prioritize Innovation: Focus on presenting unique or improved crops and services to stand out.

More Read:Free Solar Panel Scheme Registration

Expected Impact of the Schemes

The Punjab Government anticipates the following outcomes:

- Strengthened SMEs: Helping businesses grow and scale their processes.

- Increased Employment: Generating job opportunities and reducing idleness.

- Economic Stability: Boosting overall economic resilience by hopeful entrepreneurship.

These creativities aim to build a self-reliant and economically stable province.

FAQs

Can women entrepreneurs apply for the Karobar Card Loan Scheme?

Yes, the scheme is open to both men and women tycoons to promote equal business chances.

Is there a fee for applying?

No, the application process is totally free of charge.

What happens in case of loan default?

Defaulters may face penalties, legal action, or ineligibility from future schemes. Flexible repayment options are available to avoid evasions.

More Read:Benazir Kafalat Face Verification Process

Are startups eligible?

Yes, startups, especially those in IT or original sectors, are fortified to apply with a detailed business plan.

Are agricultural businesses included?

No, agricultural businesses are covered under separate wits like the Green Tractor Scheme.

Conclusion

The Karobar Card Loan Scheme and Chief Minister Asan Karobar Financing Scheme represent a transformative effort by the Punjab Rule to empower tycoons and stimulate economic growth. By offering interest-free loans, these packages provide a lifeline to small and medium businesses, fostering innovation, employment, and monetary stability. Wishful business owners are fortified to take advantage of these chances to turn their business dreams into reality.