Asaan Karobar Finance Scheme Online Registration

The Asaan Karobar Finance Scheme Online Registration is an creativity by the Punjab government aimed at if interest-free loans to small and medium-sized creativities (SMEs). With the online registering phase now active, eligible persons can apply for loans ranging from PKR 1 million to PKR 30 million to start new trades or enlarge present ones. The claim process is simple, allowing applicants to complete it from the comfort of their homes. In this guide, we’ll provide a complete overview of the scheme and a detailed step-by-step process for online registration.

More Read:KPK Ehsaas Loan Internship Program 2025

Quick Information Table

| Program Name | Asaan Karobar Finance Scheme |

| Start Date | Ongoing |

| End Date | Not specified |

| Loan Amount | PKR 1 million to PKR 30 million |

| Application Method | Online (via official website) |

| Website | akf.punjab.gov.pk |

Objectives of the Asaan Karobar Finance Scheme

The Asaan Karobar Finance scheme Online Registration is designed with several goals in mind:

- Encourage Entrepreneurship: Support startups with monetary help.

- Expand Existing Businesses: Help trades grow and update.

- Eco-Friendly Focus: Promote green businesses through Reserve Efficient Cleaner Production (RECP) technologies.

- Inclusive Growth: Offer special reasons to women, differently-abled persons, and transgender persons.

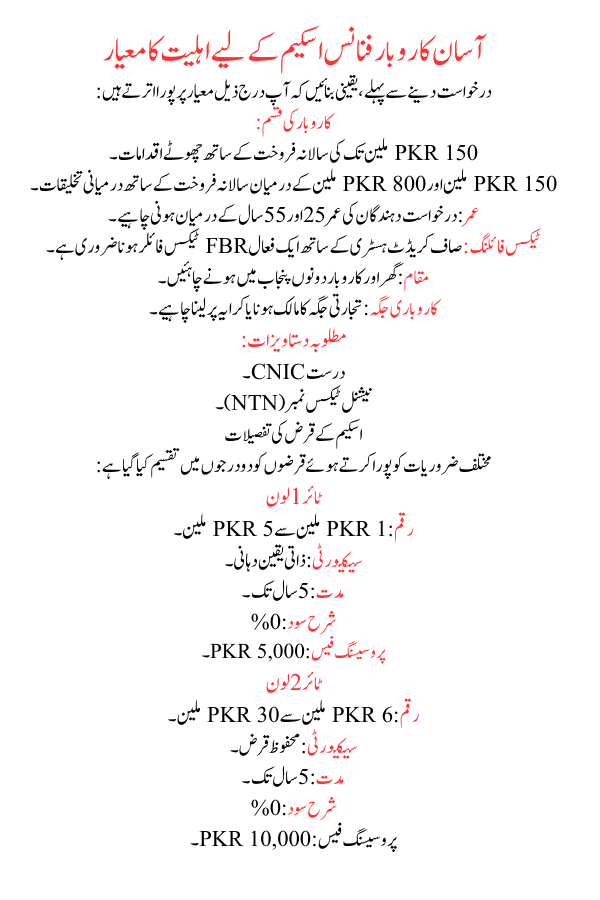

Eligibility Criteria for Asaan Karobar Finance Scheme

Before applying, ensure you meet the following criteria:

- Business Type:

- Small initiatives with annual sales up to PKR 150 million.

- Medium creativities with annual sales between PKR 150 million and PKR 800 million.

- Age: Applicants must be between 25 and 55 years old.

- Tax Filing: Must be an active FBR tax filer with a clean credit history.

- Location: Both house and business should be in Punjab.

- Business Premises: Must own or rent the place of commercial.

- Documents Required:

- Valid CNIC.

- National Tax Number (NTN).

More Read:Maryam Nawaz Negahban Program

Loan Details of the Scheme

The loans are divided into two tiers, catering to different needs:

Tier 1 Loans

- Amount: PKR 1 million to PKR 5 million.

- Security: Personal assurance.

- Tenure: Up to 5 years.

- Interest Rate: 0%.

- Processing Fee: PKR 5,000.

Tier 2 Loans

- Amount: PKR 6 million to PKR 30 million.

- Security: Secured loan.

- Tenure: Up to 5 years.

- Interest Rate: 0%.

- Processing Fee: PKR 10,000.

More Read:Benazir Kafalaat Revalidation Extra Payment

Additional Benefits

- Grace Period:

- Up to 6 months for startups.

- Up to 3 months for current businesses.

- Equity Contribution:

- 0% for Tier 1 loans (except leased vehicles).

- Special rates for women, transgender individuals, and differently-abled persons.

- Repayment: Equal monthly payments.

More Read:KPK Solar Scheme Application Form

Step-by-Step Guide to Online Registration

Step 1: Visit the Official Website

Go to the official website: akf.punjab.gov.pk. This portal is the starting point for all recordings.

Step 2: Login or Register

- Existing Users: Click on the “Login” button and enter your username and password.

- New Users: Click on the “Register Now” button to create a new account.

Step 3: Fill Out the Registration Form

Provide the following details:

- Full name (as per CNIC).

- Father’s or husband’s name.

- CNIC number.

- Date of birth, age, and CNIC issuance/expiry dates.

- Email address.

- Mobile number (and SIM ownership details).

- Residential address (province, division, district, tehsil, city).

- NTN (National Tax Number).

- Business ownership or rental details.

Step 4: Set Your Password

Create a secure password for your account and complete the registration process.

Step 5: Verify Your Email

Check your email for a verification link. Click on the link to trigger your account.

Step 6: Login to Your Account

Use your CNIC number and password to log in. This will take you to your user portal.

Step 7: Submit a New Application

Click on the “New Application” button and fill in details about:

- Your business (type, purpose, and profit).

- Land or property associated with the business.

Step 8: Verification and Approval

Once your application is submitted, it will undergo verification by the germane experts. Upon successful confirmation, the loan amount will be paid to your account via the Bank of Punjab.

More Read:Ramzan Free Atta Scheme Online Check & Apply 2025

Loan Purposes

Loans under this sch

eme can be used for:

- Starting a new business.

- Expanding or modernizing an current business.

- Leasing profitable logistics.

- Secondary eco-friendly businesses under RECP skills.

Conclusion

The Asaan Karobar Finance Scheme Online Registration is a transformative initiative aimed at allowing entrepreneurs in Punjab. Its user-friendly online recording process ensures accessibility for all eligible applicants. By offering interest-free loans, it provides an excellent opportunity for folks to achieve their business goals and contribute to fiscal growth.

Don’t miss out on this chance to secure financial support for your business. Visit akf.punjab.gov.pk and apply today to take the first step toward a wealthy future.