CM Punjab Asaan Karobar Finance Loan Scheme 2025

The Punjab government, under the control of Chief Minister Maryam Nawaz, has presented the CM Punjab Asaan Karobar Finance Loan Scheme 2025, a radical program to empower small businesses and budding tycoons. This creativity provides interest-free loans reaching from Rs 1 million to Rs 30 million, ensuring financial assistance without the burden of interest. Below, we’ll discuss all the details about the scheme, counting its aids, application process, and impact on the cheap.

More Read:Ramzan Free Atta Scheme Online Check & Apply 2025

Quick Information Table

| Program Name | CM Punjab Asaan Karobar Finance Loan Scheme 2025 |

| Start Date | January 2025 |

| End Date | December 2025 |

| Loan Amount | Rs 1 million to Rs 30 million |

| Assistance Type | Interest-Free Loans |

| Application Method | Online |

| Official Websites | akf.punjab.gov.pk, akc.punjab.gov.pk |

| Helpline | 1786 |

What is the Asaan Karobar Finance Scheme?

The Asaan Karobar Finance Loan Scheme is an advanced program planned to foster entrepreneurship and support small business owners across Punjab. With loans reaching from Rs 1 million to Rs 30 million, the package aims to:

- Encourage economic growth.

- Create job opportunities.

- Promote industrialization and small enterprises.

Chief Minister Maryam Nawaz’s creativity removes financial barriers for tycoons, focusing on empowering businesses to thrive and back to Punjab’s economic growth.

More Read:Sindh Govt Offers Free Solar Panels

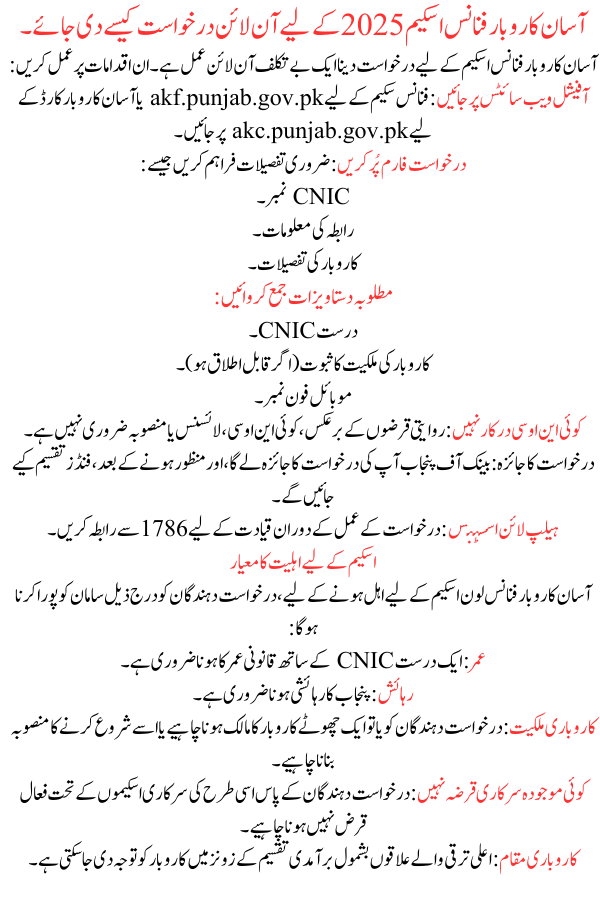

How to Apply Online for the Asaan Karobar Finance Scheme 2025

Applying for the Asaan Karobar Finance Scheme is a frank online process. Follow these steps:

- Visit Official Websites: Go to akf.punjab.gov.pk for the finance scheme or akc.punjab.gov.pk for the Asaan Karobar Card.

- Fill Out the Application Form: Provide essential details such as:

- CNIC number.

- Contact information.

- Business details.

- Submit Required Documents:

- Valid CNIC.

- Proof of business ownership (if applicable).

- Mobile phone number.

- No NOCs Required: Unlike traditional loans, no NOCs, licenses, or plans are necessary.

- Application Review: Your request will be reviewed by the Bank of Punjab, and once approved, funds will be disbursed.

- Helpline Assistance: Contact 1786 for leadership during the application process.

More Read:KPK Solar Scheme Application Form

Eligibility Criteria for the Scheme

To qualify for the Asaan Karobar Finance Loan Scheme, applicants must meet the following supplies:

- Age: Must be of legal age with a valid CNIC.

- Residency: Must be a resident of Punjab.

- Business Ownership: Applicants must either own a small business or plan to start one.

- No Existing Government Loans: Applicants should not have active loans under similar government schemes.

- Business Location: Penchant may be given to businesses in high-growth areas, including export dispensation zones.

Features of the Asaan Karobar Finance Scheme

Here are the key features of the CM Punjab Asaan Karobar Finance Loan scheme:

- Interest-Free Loans: Debtors only repay the principal amount, reaching from Rs 1 million to Rs 30 million.

- Flexible Repayment Terms: Loans are repayable in affordable payments.

- No Pre-Approval Requirements: Applicants don’t need NOCs, licenses, or blueprints, simplifying the process.

- Subsidized Land Rates: Businesses setting up actions in Punjab can benefit from reduced land costs.

- Solar Systems for Export Zones: Free solar systems worth Rs 500,000 are if to businesses in export zones, endorsing sustainability.

More Read:Maryam Nawaz Negahban Program Registration

Asaan Karobar Card: An Additional Benefit

Alongside the finance scheme, the CM Punjab Asaan Karobar Card is available to care smaller businesses. This card offers:

- Loan Range: Rs 500,000 to Rs 1 million.

- Interest-Free Financing: Ideal for small enterprises needing quick financial help.

- Ease of Access: Simple request process similar to the main scheme.

Benefits of the Asaan Karobar Finance Scheme

The program offers many advantages:

- Financial Independence: Entrepreneurs can access large funding without the load of interest.

- Boost to Small Enterprises: Delivers critical support to trades unable to secure traditional loans.

- Encourages Entrepreneurship: Removes fiscal barriers, agreeing more people to start businesses.

- Economic Growth: Augmented business activity pays to job creation and financial development.

- Sustainability Focus: Solar systems reduce working costs and promote green energy.

How This Scheme Will Impact Punjab’s Economy

The CM Punjab Asaan Karobar Finance Loan Scheme is expected to have a important impact on Punjab’s economy:

- Job Creation: Supporting small trades leads to employment chances.

- Local Manufacturing Growth: Encourages the development of trades, reducing confidence on imports.

- Export Potential: Facilities in export zones will boost Punjab’s global trade aids.

- Economic Diversification: Promotes free enterprise and progress, dipping dependence on old-style sectors.

Chief Minister Maryam Nawaz’s vision of economic inclusivity and upgrading locations Punjab as a hub for novelty and growth.

More Read:Benazir Kafalaat Revalidation

Conclusion

The Asaan Karobar Finance Loan Scheme 2025 and the Asaan Karobar Card represent a transformative chance for aspiring tycoons and small business owners in Punjab. By if interest-free loans with flexible terms, the scheme removes old-style walls to monetary support, authorizing persons to attain their business goals. If you meet the eligibility criteria, don’t miss this chance to grow your business. Apply online today and take the first step towards a wealthy future.

FAQs

How much loan can I get under the Asaan Karobar Finance Loan Scheme?

You can get loans reaching from Rs 1 million to Rs 30 million, contingent on your business needs.

Do I need any special approvals to apply for the loan?

No, the scheme does not require NOCs, licenses, or designs.

How can I apply for the loan?

Visit akf.punjab.gov.pk or akc.punjab.gov.pk, fill out the request form, and submit the required documents.

Is the loan interest-free?

Yes, the loan is totally interest-free, with only the main amount repayable in installments.

How can I get help during the application process?

You can contact the helpline at 1786 for help.