Access Your Asaan Karobar Card

The Access Your Asaan Karobar Card Loan Scheme, presented by Maryam Nawaz Sharif, aims to authorize young tycoons and support small trades in Punjab. This package delivers interest-free loans ranging from Rs. 100,000 to Rs. 1 million, allowing persons to start or enlarge their trades. Below, we’ll walk you through all the details about retrieving the Asaan Karobar Card (AKC) via the AKC Punjab Gov PK portal.

More Read:KPK Solar Scheme Application Form

Quick Information Table

| Program Name | Start Date | End Date | Loan Amount | Application Method |

| Asaan Karobar Card Loan | Ongoing | Open-ended | Rs. 100,000 to Rs. 1M | Online via portal |

What is the Asaan Karobar Card?

The Access Your Asaan Karobar Card is a financial creativity by the Punjab administration that offers interest-free loans to small trades and entrepreneurs. The program’s primary goal is to eliminate financial barriers and foster business growth in Punjab. With flexible payment terms and a focus on entrepreneurship, this scheme is ideal for new and present trades.

Principal Advantages:

- Loan Range: 100,000 to Rs. 1 million.

- Repayment Duration: Three years, including a three-month grace period.

- Interest-Free Loans: 0% interest rate.

- Business Development: Financial assistance for business-related outlays.

More Read:Ramzan Free Atta Scheme

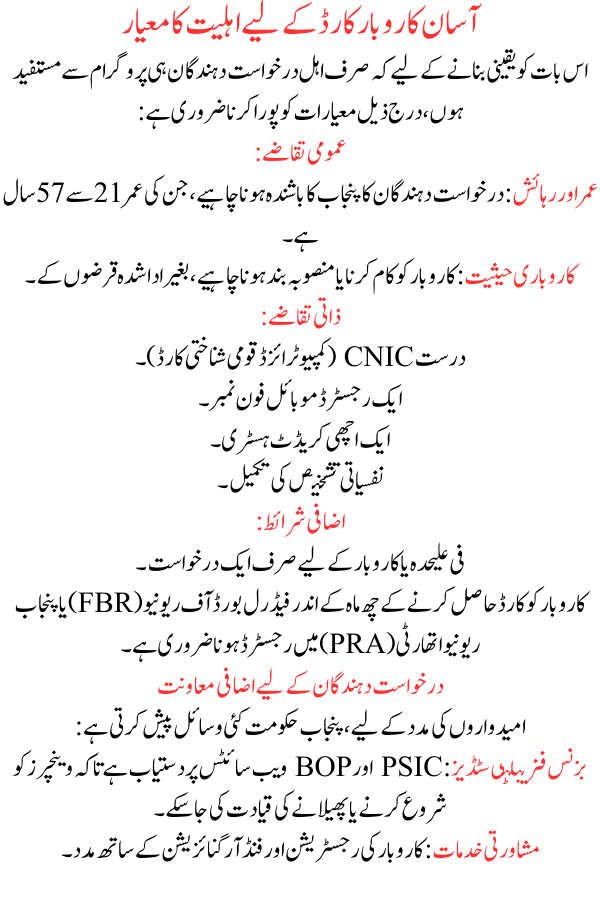

Eligibility Criteria for the Asaan Karobar Card

To ensure only eligible applicants benefit from the program, the following criteria must be met:

General Requirements:

- Age and Residency: Applicants must be inhabitants of Punjab, aged 21 to 57.

- Business Status: The business must be working or planned, with no unpaid debts.

Personal Requirements:

- Valid CNIC (Computerized National Identity Card).

- A registered mobile phone number.

- A good credit history.

- Completion of a psychological evaluation.

Additional Conditions:

- Only one application per separate or business.

- The business must be registered with the Federal Board of Revenue (FBR) or Punjab Revenue Authority (PRA) within six months of obtaining the card.

How to Apply for the Asaan Karobar Card

Step-by-Step Registration Process:

- Visit the Official Website: Pilot to the AKC Punjab Gov PK portal.

- Create an Account: Sign up using your name, CNIC, and phone number.

- Log In: Enter your badges (CNIC and chosen password) to log in.

- Fill Out Personal Details: Provide:

- Number of dependents.

- Work status and educational related.

- Business Details: Specify:

- Type of business.

- Date of establishment.

- Business address and contact information.

- Loan Amount: Select a loan between Rs. 100,000 and Rs. 1 million.

- Upload Documents: Attach copies of:

- Front and back of your CNIC.

- CNICs of business partners (if applicable).

- Pay Processing Fee: Succumb a non-refundable Rs. 500 fee.

More Read:How to Apply for Zero-Interest Loans

Loan Utilization and Repayment Terms

Loan Utilization:

- Initial Release: 50% of the loan is disbursed for essential commercial outlays.

- Final Release: Remaining 50% is released upon:

- FBR/PRA registration.

- Responsible fund usage.

- Timely repayments.

Repayment Terms:

- Grace Period: Three months.

- Repayment Period: Equal installments over two years.

- Minimum Payment: At least 5% of the loan quantity monthly.

Features and Limitations of the AKC Loan Scheme

Key Features:

- Annual Card Fee: 25,000 + FED (Federal Excise Duty).

- Security Requirements:

- Personal guarantees.

- Life assurance.

- Exclusive Use: Funds must be used solely for business drives.

Limitations:

- Late payment fees are subject to bank policy.

- Misuse of funds may result in costs.

More Read:Asaan Karobar Finance Scheme

Additional Support for Applicants

To aid candidates, the Punjab government offers several resources:

- Business Feasibility Studies: Available on the PSIC and BOP websites for leadership on launching or expanding ventures.

- Consulting Services: Assistance with business registration and fund organization.

Conclusion

The Access Your Asaan Karobar Card is a game-changer for young tycoons and small commercial owners in Punjab. Its interest-free loans, simple registration process, and lithe sum terms make it an excellent occasion for financial freedom and economic growth. To benefit from this program, visit akc.punjab.gov.pk and apply today.