Asaan Karobar Card Loan Scheme

The Asaan Karobar Card is a financial empowerment initiative launched by the Government of Punjab to support small businesses, startups, and aspiring entrepreneurs. This program is designed to provide easy access to affordable loans with minimal documentation and flexible repayment options. The aim is to foster economic growth, create jobs, and enable individuals to achieve financial independence.

With the Asaan Karobar Card, eligible applicants can access loans to start or expand their businesses, making it a game-changer for the entrepreneurial landscape in Pakistan.

Quick Information Table

| Program Name | Asaan Karobar Card |

| Launched By | Government of Punjab |

| Start Date | January 2025 |

| End Date | Ongoing |

| Maximum Loan Amount | Up to 10 million PKR |

| Application Method | Online and Offline |

| Eligibility | Small businesses, startups, entrepreneurs |

| Interest Rate | Subsidized, 3% to 8% |

Key Features of the Asaan Karobar Card Loan Scheme

The Asaan Karobar Card offers several features that make it accessible and beneficial for entrepreneurs:

- Low-Interest Rates:

- Loans are available at subsidized rates, ranging from 3% to 8%, depending on the loan tier.

- Flexible Loan Amounts:

- Applicants can avail loans up to 10 million PKR, catering to various business needs.

- Ease of Application:

- Both online and offline registration methods are available for maximum convenience.

- No Extensive Collateral:

- Microloans (up to 500,000 PKR) do not require collateral, making them accessible for startups and small businesses.

- Priority for Women Entrepreneurs:

- Special incentives and fast-track processing for women-led businesses.

- Repayment Flexibility:

- Loans can be repaid over a period of up to 7 years, ensuring ease for borrowers.

Read More:CM Punjab Asaan Karobar Finance Loan Scheme

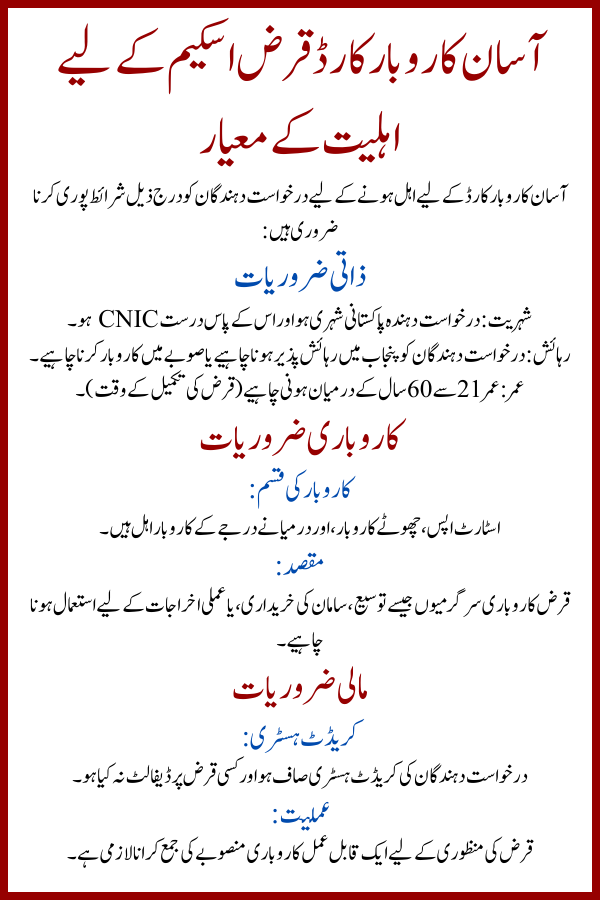

Eligibility Criteria for the Asaan Karobar Card Loan Scheme

To qualify for the Asaan Karobar Card, applicants must meet the following requirements:

Personal Requirements

- Nationality: Must be a Pakistani citizen with a valid CNIC.

- Residency: Applicants should reside in Punjab or operate a business in the province.

- Age: Must be between 21 and 60 years (at the time of loan maturity).

Business Requirements

- Type of Business:

- Startups, small enterprises, and medium-sized businesses are eligible.

- Purpose:

- Loans should be used for business-related activities such as expansion, equipment purchase, or operational costs.

Financial Requirements

- Credit History:

- Applicants should have a clean credit record and no loan defaults.

- Feasibility:

- Submission of a feasible business plan is mandatory for loan approval.

Read More:Maryam Nawaz Sharif Launches Karobar Card

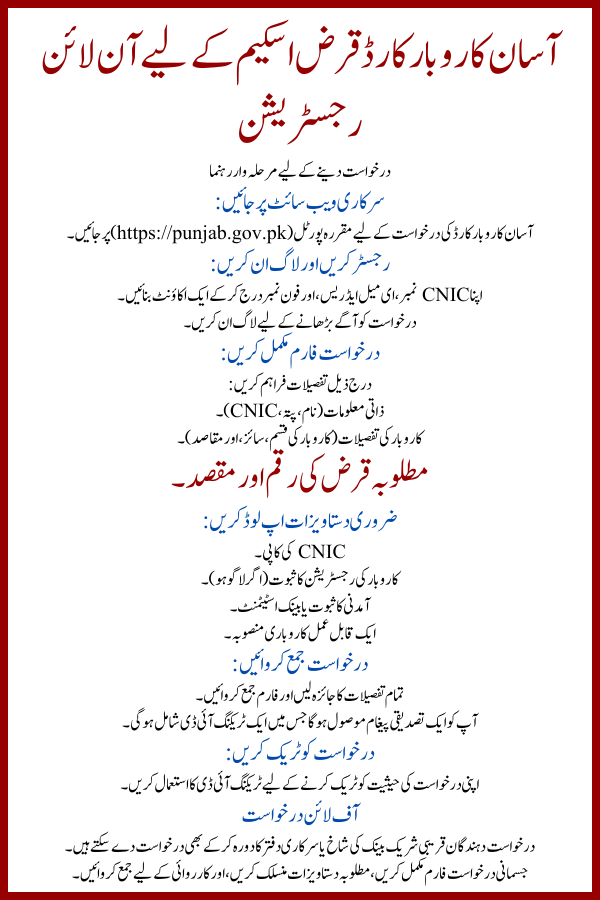

Asaan Karobar Card Loan Scheme Online Registration

Step-by-Step Guide to Apply

- Visit the Official Website:

- Go to the designated portal (https://punjab.gov.pk) for Asaan Karobar Card applications.

- Register and Log In:

- Create an account by entering your CNIC number, email address, and phone number. Log in to proceed.

- Fill Out the Application Form:

- Provide details such as:

- Personal information (name, address, CNIC).

- Business details (type, size, and goals).

- Loan amount required and purpose.

- Provide details such as:

- Upload Necessary Documents:

- CNIC copy.

- Proof of business registration (if applicable).

- Income proof or bank statements.

- A feasible business plan.

- Submit the Application:

- Review the details and submit the form. You will receive a confirmation message with a tracking ID.

- Track Your Application:

- Use the tracking ID to monitor your application status.

Offline Application

Applicants can also apply by visiting the nearest participating bank branch or government office. Fill out the physical application form, attach the required documents, and submit it for processing.

Read More: Scholarship Program to KP and Balochistan 2025

Loan Usage and Repayment Terms

Permitted Loan Uses:

- Starting a new business.

- Expanding existing operations.

- Purchasing equipment or machinery.

- Covering operational costs.

Repayment Terms:

- Repayment periods range from 1 to 7 years, depending on the loan amount.

- Early repayment options are available without penalties.

Charges and Security Details

- Interest Rates:

- Subsidized rates of 3% to 8%, are significantly lower than traditional market rates.

- Collateral Requirements:

- Microloans (up to 500,000 PKR): No collateral required.

- Small and medium loans (500,001 to 10 million PKR): Collateral may be needed based on the loan amount and risk assessment.

- Processing Fees:

- Minimal or no processing fees for loan applications under the scheme.

Additional Support for Applicants

The Asaan Karobar Card program also provides additional resources to ensure the success of funded businesses:

- Training Programs:

- Free workshops and training sessions on business management, financial planning, and digital marketing.

- Advisory Services:

- Access to business consultants for creating and implementing growth strategies.

- Networking Opportunities:

- Participation in trade fairs, expos, and business forums.

Conclusion

The Asaan Karobar Card Loan Scheme is a landmark initiative by the Punjab government to support small businesses and entrepreneurs. With its affordable loans, user-friendly application process, and comprehensive support services, the program is a golden opportunity for individuals to start or expand their ventures.

If you are a budding entrepreneur or a small business owner, don’t miss the chance to benefit from this scheme. Apply today, secure your financial future, and contribute to the economic growth of Punjab and Pakistan.

Read More: Punjab Laptop Scheme Distribution

FAQs

1. What is the Asaan Karobar Card Loan Scheme?

The Asaan Karobar Card is a government initiative providing easy loans to small businesses, startups, and entrepreneurs in Punjab.

2. What is the maximum loan amount available under the scheme?

Applicants can receive loans of up to 10 million PKR, depending on their business needs.

3. Who is eligible for the Asaan Karobar Card?

Pakistani citizens residing in Punjab, aged between 21 and 60, and owning or planning a business, are eligible.

4. How can I apply for the card?

You can apply online through the official portal or offline at participating bank branches.

5. What is the interest rate for the loans?

The scheme offers subsidized interest rates ranging from 3% to 8%.

6. Can women entrepreneurs apply for the card?

Yes, women entrepreneurs are encouraged to apply and are given priority under the program.

Read More: