Asaan Karobar Finance Program

The Government of Punjab has launched the Asaan Karobar Finance Scheme, a groundbreaking initiative aimed at empowering small businesses, startups, and individuals who dream of becoming entrepreneurs. This program offers easy loans with subsidized interest rates to promote economic growth and create job opportunities in the region. With simplified processes and a focus on inclusivity, the scheme is a game-changer for the entrepreneurial ecosystem in Punjab.

Quick Information Table

| Program Name | Asaan Karobar Finance Scheme |

| Start Date | January 2025 |

| End Date | Ongoing |

| Loan Amount | Up to 10 million PKR |

| Eligibility | Small businesses, startups, entrepreneurs |

| Application Method | Online and Offline |

| Interest Rate | Subsidized, 3% to 8% |

What is the Asaan Asaan Karobar Finance Program?

The Asaan Karobar Finance Scheme is a government-backed program initiated to support small and medium enterprises (SMEs) and promote entrepreneurship in Punjab. The scheme provides financial assistance through easy loans, making it accessible for individuals with limited resources or no collateral. By addressing key challenges faced by budding entrepreneurs, this initiative aims to foster sustainable business growth and strengthen Punjab’s economy.

The scheme focuses on inclusivity by offering loans at affordable interest rates and ensuring the application process is simple and transparent. It is a beacon of hope for individuals with innovative ideas but lacking the financial backing to bring them to life.

Key Features of the Scheme

- Subsidized Interest Rates: Loans are provided at a minimal interest rate, ranging between 3% and 8%.

- Flexible Loan Amounts: From small amounts for startups to larger sums for established businesses, the scheme caters to diverse financial needs.

- Streamlined Application Process: The application process is designed to be user-friendly, both online and offline.

- Special Focus on Women Entrepreneurs: Women-led businesses are encouraged with priority approvals and additional support.

- Repayment Flexibility: Borrowers can repay the loan over a comfortable period of up to 7 years.

Read More:CM Maryam Nawaz Launches Asaan Karobar Card Scheme

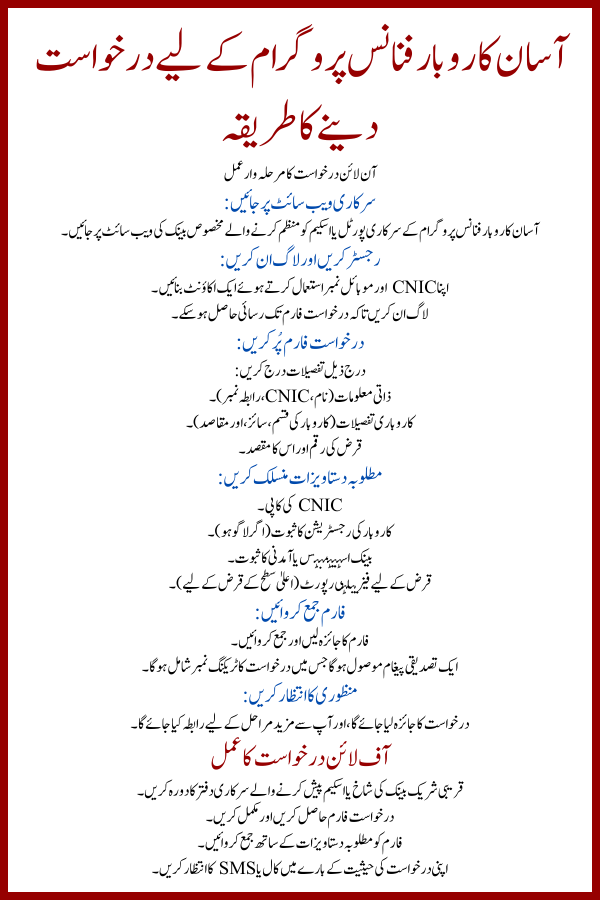

How to Apply for the Asaan Karobar Finance Program

Step-by-Step Online Application Process

- Visit the Official Website:

- Go to the official portal for the Asaan Karobar Finance Program or the designated bank website managing the scheme.

- Register and Log In:

- Create an account using your CNIC and mobile number.

- Log in to access the application form.

- Fill Out the Application Form:

- Enter details such as:

- Personal information (name, CNIC, contact number).

- Business details (type, size, and goals of your business).

- Loan amount and purpose.

- Enter details such as:

- Attach Required Documents:

- CNIC copy.

- Proof of business registration (if applicable).

- Bank statements or income proof.

- Feasibility report for the loan (for higher tiers).

- Submit the Form:

- Review the form and submit it.

- A confirmation message will be sent with an application tracking number.

- Await Approval:

- The application will be reviewed, and you will be contacted for further steps.

Offline Application Process

- Visit the nearest participating bank branch or government office offering the scheme.

- Collect and fill out the application form.

- Submit the form along with the required documents.

- Await a call or SMS regarding your application status.

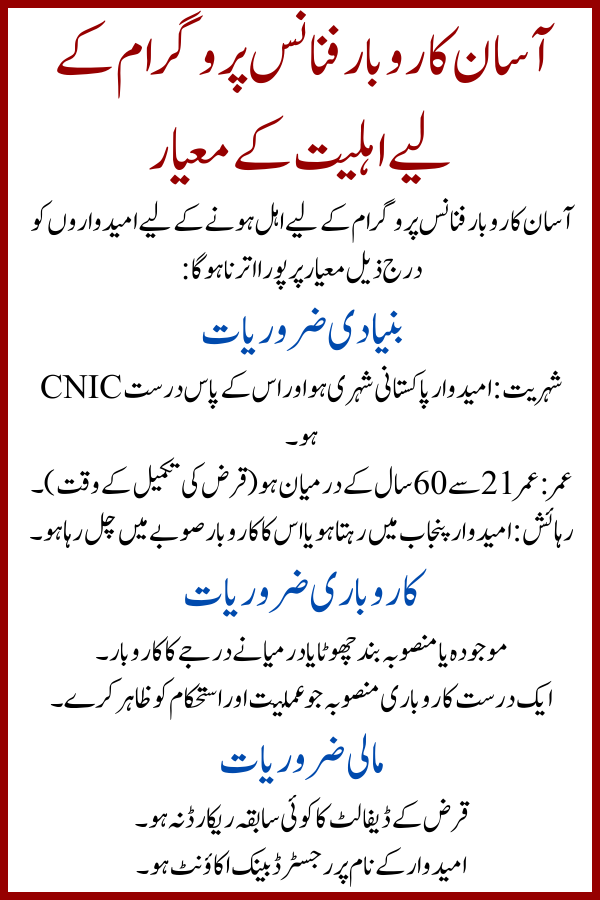

Eligibility Criteria for Asaan Karobar Finance Program

To qualify for the Asaan Karobar Finance Program, applicants must meet the following criteria:

Basic Requirements

- Nationality: Must be a Pakistani citizen with a valid CNIC.

- Age: Between 21 and 60 years (at the time of loan maturity).

- Residency: Must reside in Punjab or own a business operating in the province.

Business Requirements

- Existing or planned small or medium enterprise.

- A valid business plan demonstrating feasibility and sustainability.

Financial Requirements

- No history of loan defaults.

- A bank account registered in the applicant’s name.

Read More:Asaan Karobar Finance Scheme

Loan Details

The scheme offers loans in different tiers based on the applicant’s business needs:

Tier 1: Microloans

- Loan Amount: Up to 500,000 PKR.

- Interest Rate: 3% to 5%.

- Collateral: Not required.

- Repayment Period: Up to 3 years.

Tier 2: Small Business Loans

- Loan Amount: 500,001 PKR to 5 million PKR.

- Interest Rate: 4% to 6%.

- Collateral: May be required based on the amount.

- Repayment Period: Up to 5 years.

Tier 3: Medium Business Loans

- Loan Amount: 5 million PKR to 10 million PKR.

- Interest Rate: 5% to 8%.

- Collateral: Required.

- Repayment Period: Up to 7 years.

Benefits of the Asaan Karobar Finance Program

- Economic Growth:

- The scheme contributes to job creation and economic stability by enabling businesses to grow.

- Support for Underserved Groups:

- Special provisions for women entrepreneurs and rural businesses.

- Access to Finance:

- Provides easy access to loans without lengthy paperwork or high collateral requirements.

- Encourages Innovation:

- Entrepreneurs with unique ideas can secure funding to bring their concepts to life.

- Job Creation:

- Helps reduce unemployment by fostering entrepreneurship.

Why the Asaan Karobar Finance Scheme Matters

The scheme is more than just a loan program—it’s a stepping stone for entrepreneurs to realize their dreams. It addresses long-standing barriers to business financing in Punjab and empowers individuals to contribute to the province’s economic development.

Read More: Scholarship Program to KP and Balochistan 2025

Conclusion

The Asaan Karobar Finance Program is a transformative initiative that provides much-needed financial support to entrepreneurs and small businesses in Punjab. With its simple application process, affordable interest rates, and flexible repayment terms, the scheme is an excellent opportunity for anyone looking to start or expand their business.

If you meet the eligibility criteria, apply today to take the first step toward realizing your entrepreneurial dreams. For the best results, prepare a detailed business plan, complete your application accurately, and stay informed about updates on the official portal. This scheme is a beacon of hope for Pakistan’s aspiring business community and promises a brighter future for Punjab’s economy.

Read More: