Bank Islami Solar Loan

With rising electricity costs and common power lacks in Pakistan, solar energy is becoming an beautiful another. However, the upfront cost of solar connections is a important barrier for many households and businesses. Bank Islami addresses this issue with its Shariah-compliant Bank Islami Solar Loan, making solar energy more accessible and reasonable.

This article will guide you through everything you need to know about Bank Islami’s Solar Loan, counting its features, application process, eligibility criteria, and benefits.

More Read:CM Punjab Minority Card Program

Quick Information Table

| Program Name | Bank Islami Solar Loan |

| Loan Coverage | Up to 80% of the total system cost |

| Repayment Period | 3 to 5 years |

| Financing Model | Diminishing Musharakah (Shariah-compliant) |

| Application Method | Online and Offline |

What Is Bank Islami’s Solar Loan?

Bank Islami’s Solar Loan is a Shariah-compliant backing solution intended to make solar energy affordable for residential and commercial users. The loan is offered under the Diminishing Musharakah model, which confirms no interest (riba) is charged. This Islamic backing structure allows customers to gradually buy the bank’s share of the solar system while enjoying the benefits of solar energy.

Why Choose Bank Islami’s Solar Loan?

- Shariah-Compliant Financing

The loan is completely interest-free, adhering to Islamic values. It is an brilliant option for individuals who wish to avoid riba (interest) while transitioning to clean energy.

- Energy Cost Savings

Solar power reduces electricity bills knowingly. Many users find that their monthly savings cover the loan payments, making the switch monetarily wieldy.

- Reliable and Certified Systems

Bank Islami Solar Loan partners with certified solar vendors, certifying high-quality networks for long-term consistency.

- Flexible Repayment Options

Repayment periods range from 3 to 5 years, letting customers to choose terms that best suit their monetary illness.

- Environmentally Friendly

Solar energy reduces dependence on fossil fuels, cutting down carbon releases and causal to a greener Pakistan.

More Read:CM Punjab Free Solar Panel Scheme

Key Features of the Solar Loan

- Loan Coverage: Finances up to 80% of the solar system’s cost.

- Flexible Terms: Offers repayment plans over 3 to 5 years.

- Certified Vendors: Works with trusted solar energy providers.

- Dual Purpose: Available for both residential and commercial installations.

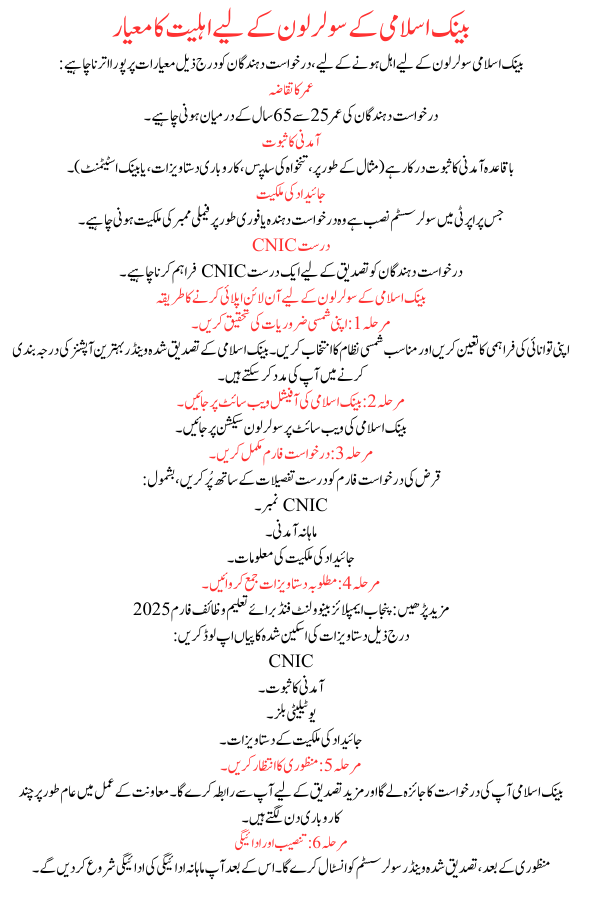

Eligibility Criteria for Bank Islami’s Solar Loan

To qualify for the Bank Islami Solar Loan, applicants must meet the following criteria:

- Age Requirement

- Applicants must be between 25 and 65 years old.

- Income Proof

- Regular income proof is required (e.g., salary slips, business documents, or bank statements).

- Property Ownership

- The property where the solar system is installed must be owned by the applicant or an instant family member.

- Valid CNIC

- Applicants must provide a valid CNIC for verification.

More Read:Minority Card Online Registration

How to Apply Online for Bank Islami’s Solar Loan

Step 1: Research Your Solar Needs

Determine your energy supplies and select an suitable solar system. Bank Islami’s certified vendors can assist you in classifying the best options.

Step 2: Visit Bank Islami’s Official Website

Navigate to the solar loan section on the Bank Islami website.

Step 3: Complete the Application Form

Fill out the loan application form with precise details, including:

- CNIC number.

- Monthly income.

- Property ownership information.

Step 4: Submit Required Documents

More Read:Punjab Employees Benevolent Fund for Taleemi Wazaif Form 2025

Upload scanned copies of the following documents:

- CNIC.

- Proof of income.

- Utility bills.

- Property ownership documents.

Step 5: Wait for Approval

Bank Islami will review your application and contact you for further confirmation. The support process typically takes a few business days.

Step 6: Installation and Payment

Once approved, the certified vendor will install the solar system. You will then begin making monthly payment payments.

How Does the Diminishing Musharakah Model Work?

The loan operates under the Diminishing Musharakah model, which involves shared possession between the bank and the customer:

- Joint Ownership:

The bank and customer jointly acquisition the solar system. For example, if the system costs PKR 500,000, the bank finances up to 80% (PKR 400,000), and the client pays the remaining 20% upfront. - Monthly Installments:

Each installment consists of:- Payment toward ownership: Gradually surges the customer’s share.

- Rent: Covers the use of the bank’s share.

- Complete Ownership Transfer:

Over time, the customer becomes the sole owner of the system.

More Read: Apply for Chief Minister Solarization Program

Benefits of Using Solar Energy

- Save Money: Solar systems reduce requirement on grid electricity, lowering monthly bills.

- Energy Independence: Solar panels provide consistent power during outages.

- Eco-Friendly Solution: Helps combat climate change by plummeting carbon releases.

FAQs (Frequently Asked Questions)

Is this loan available for businesses?

Yes, Bank Islami offers solar financing for both housing and lucrative goods.

How much of the solar system’s cost can I finance?

The bank finances up to 80% of the total cost.

Are there any hidden charges?

No, the loan is see-through and free of hidden charges.

More Read:Punjab Minority Card registration closes on 5 January 2025

How long does approval take?

Loan approval typically takes a few business days, if all documents are submitted correctly.

Can I sell excess electricity to the grid?

Yes, under Pakistan’s net metering policy, you can sell surplus power back to the grid.

Conclusion

Bank Islami’s Solar Loan is an excellent initiative for those looking to switch to solar energy without liaising their financial or religious principles. By offering a flexible, interest-free financing option, the bank makes solar energy accessible to households and businesses across Pakistan. Apply online today to take the first step toward energy freedom and a greener futur