CM Asaan Karobar Finance Scheme 2025

The CM Asaan Karobar Finance Scheme 2025 is a innovative initiative hurled by Punjab Governor Maryam Nawaz Sharif on January 18, 2025. This program aims to authorize small and medium-sized enterprises (SMEs) and persons by if interest-free loans to boost economic activity, surge service, and drive spreads in Punjab. Managed by the Bank of Punjab, this scheme provides loans of up to Rs. 30 million, offering trades financial help to thrive. Here’s everything you need to know about the scheme, application process, and key details.

More Read:Ramzan Free Atta Scheme Online Check & Apply 2025

Quick Information Table

| Program Name | CM Asaan Karobar Finance Scheme 2025 |

| Start Date | January 17, 2025 |

| End Date | Not Announced |

| Loan Amount | Rs. 5 lakh to Rs. 30 million |

| Method of Application | Online via akf.punjab.gov.pk |

| Helpline Number | 1786 |

| Application Fee | Tier 1: PKR 5,000; Tier 2: PKR 10,000 |

Key Features of the Scheme

Economic Growth and Financial Inclusion

The Asaan Karobar Finance Scheme is intended to empower businesspersons across Punjab by providing loans that are:

- Interest-free loans: Ensuring convenience for small businesses.

- Loan amounts up to Rs. 30 million: Catering to various business needs.

- Special focus on SMEs: Inspiring growth in agriculture, trade, and service sectors.

Inclusivity

The scheme supports folks from diverse families, ensuring impartial chances for all genders and publics to donate to the cheap.

More Read:Assan Karobar Finance Scheme for SMEs

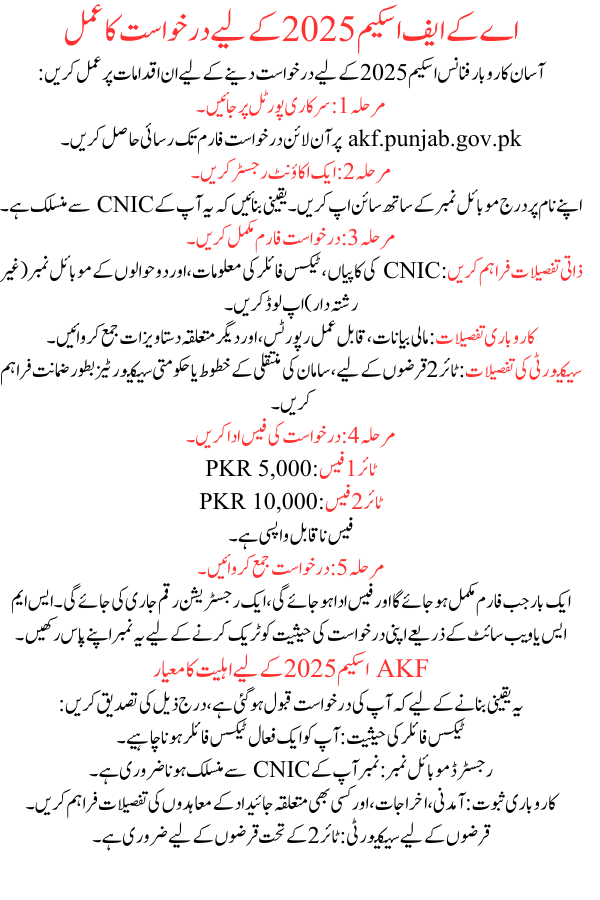

Application Process for AKF Scheme 2025

Follow these steps to apply for the Asaan Karobar Finance Scheme 2025:

Step 1: Visit the Official Portal

Access the online application form at akf.punjab.gov.pk.

Step 2: Register an Account

Sign up with a mobile number listed in your name. Ensure it is linked to your CNIC.

Step 3: Complete the Application Form

- Provide Personal Details: Upload CNIC copies, tax filer info, and mobile numbers of two references (non-relatives).

- Business Details: Submit financial statements, viability reports, and other pertinent documents.

- Security Details: For Tier 2 loans, provide stuff transfer letters or government securities as collateral.

Step 4: Pay the Application Fee

- Tier 1 Fee: PKR 5,000

- Tier 2 Fee: PKR 10,000

The fee is non-refundable.

Step 5: Submit the Application

Once the form is completed and fee is paid, a registering amount will be issued. Keep this number to track your application status via SMS or the website.

More Read:KPK Solar Scheme Application Form

Eligibility Criteria for AKF Scheme 2025

To ensure your application is accepted, verify the following:

- Tax Filer Status: You must be an active tax filer.

- Registered Mobile Number: The number must be linked to your CNIC.

- Business Proof: Provide details of income, outlays, and any relevant property contracts.

- Security for Loans: Necessary for loans under Tier 2.

More Read:CM Punjab Asaan Karobar Finance Loan Scheme

Loan Details and Repayment

The loan structure is as follows:

- Amount: Ranges from Rs. 5 lakh to Rs. 30 million.

- Repayment Terms: Loans are repayable in easy installments, making it cheap for small businesses to manage repayments.

- Asaan Karobar Card: Used to facilitate payout for loans between Rs. 5 lakh and Rs. 10 lakh.

Benefits of the Asaan Karobar Scheme

For Individuals

- Easy access to capital for launching or growing businesses.

- Encouragement for women and youth tycoons to contribute in economic doings.

For Punjab’s Economy

- Increased exports and job making.

- Growth in small-scale industries, farming, and services.

Important Points to Note

- Helpline Support: For help, call 1786.

- Draft Saving: Applications can be saved and completed later if needed.

- Processing Time: Begins after plan of all required documents and payment of fees.

More Read:Asaan Karobar Finance Scheme

FAQs

What is the last date to apply for the scheme?

The end date has not been publicized yet, but applications are now open.

Can I apply offline?

No, the application process is entirely online via the official website.

Who is eligible for the scheme?

Any individual or SME meeting the criteria, counting being a tax filer and having a registered mobile number, can apply.

Are there any additional charges?

Apart from the application fee, no extra charges are mentioned for the application process.

Conclusion

The CM Asaan Karobar Finance Scheme 2025 is a transformative step to nurturing free enterprise and fiscal growth in Punjab. By donation interest-free loans and an inclusive application process, this initiative ensures that businesses across the area can access the provision they need to thrive. Apply today at akf.punjab.gov.pk and take the first step towards monetary individuality and commercial victory.