CM Punjab Asaan Karobar Finance Loan Scheme

The CM Punjab Asaan Karobar Finance Loan Scheme 2025 is a flagship initiative of the Government of Punjab to support small businesses and budding entrepreneurs. This scheme is designed to provide financial assistance to individuals looking to start or expand their businesses. By offering loans with low-interest rates and flexible repayment terms, the program aims to foster economic growth, reduce unemployment, and empower the small business sector across the province.

This article provides a complete guide to the CM Punjab Asaan Karobar Finance Loan Scheme 2025, covering its application process, eligibility criteria, benefits, and much more.

Read More: CM Maryam Nawaz Launches Asaan Karobar Card Scheme

Quick Information Table

| Program Name | CM Punjab Asaan Karobar Finance Loan Scheme 2025 |

| Launched By | Government of Punjab |

| Start Date | January 2025 |

| End Date | Ongoing |

| Loan Amount | Up to 10 million PKR |

| Interest Rate | Subsidized, 3% to 8% |

| Eligibility | Small businesses and entrepreneurs in Punjab |

| Application Method | Online and Offline |

Overview of the Asaan Karobar Finance Loan Scheme

The Asaan Karobar Finance Loan Scheme is tailored to assist small and medium enterprises (SMEs) and individuals who aspire to become entrepreneurs. With simplified procedures, transparent processing, and a focus on inclusivity, the scheme provides much-needed financial support to small businesses. The initiative is a part of the Punjab government’s broader vision of fostering economic empowerment and creating sustainable livelihoods for the people of the province.

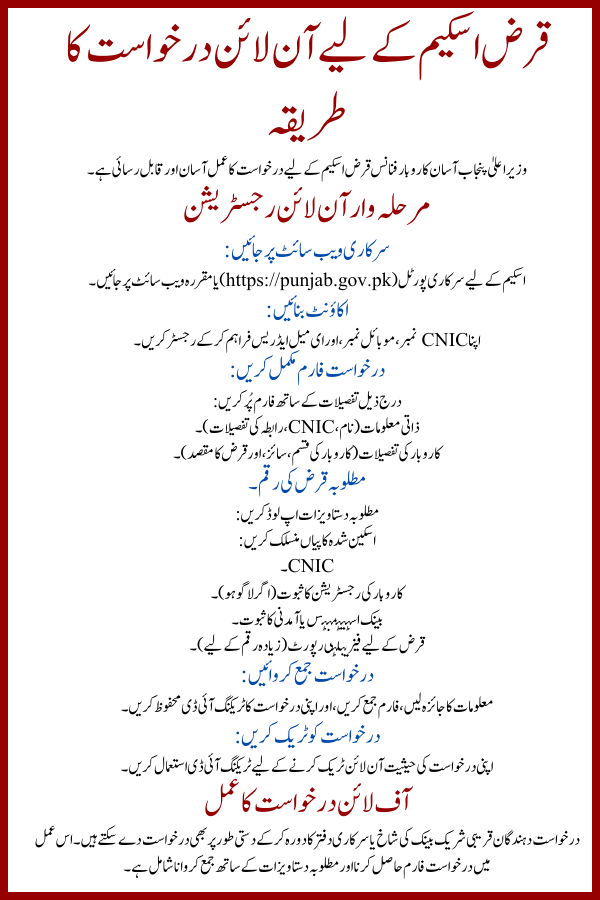

How to Apply Online for the Loan Scheme

The application process for the CM Punjab Asaan Karobar Finance Loan Scheme is straightforward and accessible.

Step-by-Step Online Registration

- Visit the Official Website:

- Navigate to the official portal (https://punjab.gov.pk) or the designated website for the scheme.

- Create an Account:

- Register by providing your CNIC number, mobile number, and email address.

- Complete the Application Form:

- Fill in the details, including:

- Personal information (name, CNIC, contact details).

- Business details (type, size, and purpose of the loan).

- Loan amount required.

- Fill in the details, including:

- Upload Required Documents:

- Attach scanned copies of:

- CNIC.

- Business registration proof (if applicable).

- Bank statements or income proof.

- Feasibility report for the loan (for higher amounts).

- Attach scanned copies of:

- Submit the Application:

- Review the information, submit the form, and save your application tracking ID.

- Track Your Application:

- Use your tracking ID to monitor your application status online.

Offline Application Process

Applicants can also visit the nearest participating bank branch or government office to apply manually. The process involves collecting and submitting a physical application form along with the required documents.

Read More: Punjab Laptop Scheme Distribution

Eligibility Criteria for Karobar Finance Loan

To qualify for the CM Punjab Asaan Karobar Finance Loan Scheme, applicants must meet the following criteria:

Personal Requirements

- Nationality: Must be a Pakistani citizen with a valid CNIC.

- Residency: Must reside in Punjab or own a business in the province.

- Age Limit: Between 21 and 60 years (at the time of loan maturity).

Business Requirements

- Business Type:

- Startups, small enterprises, and medium-sized businesses.

- Purpose:

- Loans can be used for starting a new business, expanding an existing one, or upgrading equipment.

Financial Standing

- Credit History: Applicants must not have defaulted on previous loans.

- Feasibility: A viable and sustainable business plan is mandatory for loan approval.

Loan Details

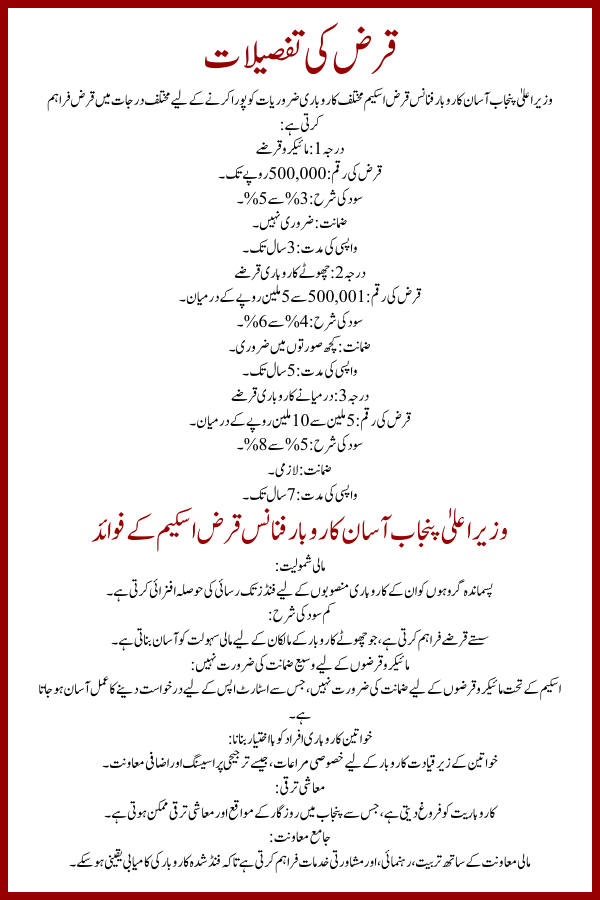

The CM Punjab Asaan Karobar Finance Loan Scheme offers loans in different tiers to cater to diverse business needs:

Tier 1: Microloans

- Loan Amount: Up to 500,000 PKR.

- Interest Rate: 3% to 5%.

- Collateral: Not required.

- Repayment Period: Up to 3 years.

Tier 2: Small Business Loans

- Loan Amount: Between 500,001 and 5 million PKR.

- Interest Rate: 4% to 6%.

- Collateral: Required in some cases.

- Repayment Period: Up to 5 years.

Tier 3: Medium Business Loans

- Loan Amount: Between 5 million and 10 million PKR.

- Interest Rate: 5% to 8%.

- Collateral: Mandatory.

- Repayment Period: Up to 7 years.

Read More:Asaan Karobar Finance Scheme

Benefits of the CM Punjab Asaan Karobar Finance Loan Scheme

- Financial Inclusion:

- Encourages underserved groups to access funding for their business ventures.

- Low-Interest Rates:

- Offers affordable loans, making financing accessible for small business owners.

- No Extensive Collateral for Microloans:

- Microloans under the scheme do not require collateral, easing the application process for startups.

- Empowering Women Entrepreneurs:

- Special provisions for women-led businesses, including priority processing and additional support.

- Economic Growth:

- Promotes entrepreneurship, leading to job creation and economic development in Punjab.

- Comprehensive Support:

- Offers training, mentorship, and advisory services to ensure the success of funded businesses.

Read More:Scholarship Program to KP and Balochistan 2025

Why the CM Punjab Asaan Karobar Finance Loan Scheme Matters

The scheme is more than just a financial assistance program—it represents a commitment to empowering the small business sector in Punjab. By addressing the challenges of access to credit and providing low-cost financing, the initiative contributes to:

- Economic Development:

- Strengthening local economies through business growth.

- Poverty Alleviation:

- Creating job opportunities and promoting financial independence.

- Entrepreneurial Ecosystem:

- Encouraging innovation and fostering a culture of entrepreneurship in Punjab.

Conclusion

The CM Punjab Asaan Karobar Finance Loan Scheme 2025 is a transformative initiative designed to support small businesses and entrepreneurs in Punjab. With its low-interest loans, streamlined application process, and focus on inclusivity, the scheme is a golden opportunity for anyone looking to start or expand their business.

If you meet the eligibility criteria, don’t wait—apply today and take the first step toward realizing your entrepreneurial dreams. By leveraging this program, you can contribute to your personal growth as well as the economic development of Punjab.

Read More: Asaan Karobar Finance Program launched in Punjab

FAQs

1. Who can apply for the CM Punjab Asaan Karobar Finance Loan Scheme?

Entrepreneurs and small business owners residing in Punjab and meeting the eligibility criteria can apply.

2. What is the maximum loan amount available?

Loans of up to 10 million PKR are available under the scheme.

3. How can I apply for the loan?

Applications can be submitted online through the official portal or offline at designated branches.

4. What documents are required for the application?

Documents include CNIC, proof of business registration, income proof, and a business plan.

5. Are there special provisions for women entrepreneurs?

Yes, women-led businesses are prioritized and provided with additional support.

6. Is collateral required for all loans?

Collateral is not required for microloans but may be needed for higher loan amounts.

Read More: