CM Punjab Asaan Karobar Loan Scheme 2025

The CM Punjab Asaan Karobar Loan Scheme 2025 is a transformative creativity by the Punjab government under the leadership of Chief Minister Maryam Nawaz. This program aims to support small businesses and budding entrepreneurs by if interest-free loans of up to Rs. 30 million. With a focus on economic enabling, the scheme ensures simplified processes, making it easier for folks to access capital. In this article, we will cover all aspects of the scheme, counting benefits, eligibility, claim process, and detailed loan building.

More Read:Asaan Karobar Finance Scheme Online Registration

Quick Overview of the CM Punjab Asaan Karobar Loan Scheme 2025

| Feature | Details |

| Program Name | CM Punjab Asaan Karobar Loan Scheme 2025 |

| Start Date | January 2025 |

| End Date | December 2025 |

| Loan Amount | Up to Rs. 30 million |

| Interest Rate | 0% (Interest-Free Loans) |

| Application Mode | Online via akf.punjab.gov.pk |

What is the CM Punjab Asaan Karobar Loan Scheme?

The Asaan Karobar Loan Scheme (AKLS) 2025 is calculated to empower small and average businesses (SMEs) in Punjab. By if interest-free loans, business-friendly rules, and motivations like solar systems, the scheme seeks to enhance the entrepreneurial ecosystem in the province. It offers financial support, helping trades scale operations and donate to financial growth.

Key Features of the Asaan Karobar Scheme

- High Loan Limits

Businesses can borrow up to Rs. 30 million, separated into two tiers, with minimal dispensation fees and no interest charges. - Simplified Process

No complicated approvals, NOCs, or certificates are required, confirming quick and easy access to funds. - Business-Friendly Policies

Loan usage is restricted to business-related activities such as vendor expenses, taxes, and utility bills, hopeful proper use. - Support for Growth Areas

The scheme orders businesses in high-growth possible zones, especially export dispensation areas, to drive financial growth.

More Read:CM Asaan Karobar Finance Scheme 2025

Loan Details and Terms

Loan Tiers

- Tier 1: Rs. 1 million to Rs. 5 million with a dispensation fee of Rs. 5,000.

- Tier 2: Rs. 6 million to Rs. 30 million with a dispensation fee of Rs. 10,000.

Both tiers offer:

- Interest Rate: 0%

- Repayment Period: Up to 5 years

CM Punjab Loan Scheme Specifics

| Details | Description |

| First 50% Limit | Accessible within the first 6 months |

| Grace Period | 3 months after card issuance before payments begin |

| Repayment | Minimum monthly payment: 5% of the outstanding balance (principal only) |

| Second 50% Limit | Released upon timely repayments and tax registration (PRA/FBR) |

| Usage Restrictions | Non-business outlays such as entertaining or personal costs are blocked |

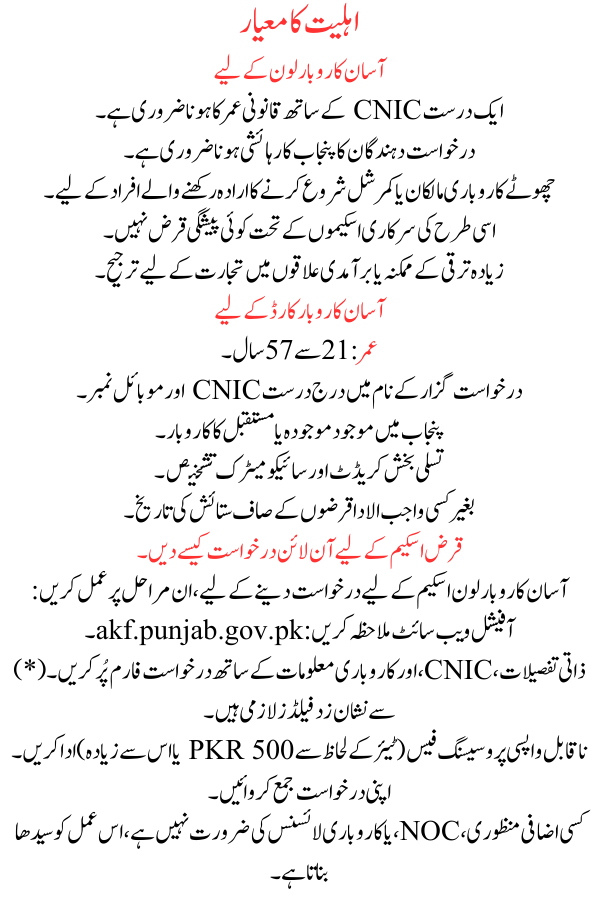

Eligibility Criteria

For Asaan Karobar Loan

- Must be of legal age with a valid CNIC.

- Applicants must be residents of Punjab.

- Intended for small business owners or persons planning to start a commercial.

- No prior loans under similar government schemes.

- Preference for trades in high-growth possible or export zones.

For Asaan Karobar Card

- Age: 21 to 57 years.

- Valid CNIC and mobile number listed in the applicant’s name.

- Existing or future business located in Punjab.

- Satisfactory credit and psychometric valuations.

- Clean praise history with no overdue loans.

More Read:How to Apply for Zero-Interest Loans

How to Apply Online for the Loan Scheme

To apply for the Asaan Karobar Loan Scheme, follow these steps:

- Visit the official website: akf.punjab.gov.pk.

- Fill out the application form with personal details, CNIC, and business information. Fields marked with (*) are mandatory.

- Pay the non-refundable processing fee (PKR 500 or more depending on the tier).

- Submit your application.

No additional approvals, NOCs, or business licenses are required, making the process straightforward.

How to Apply for the Asaan Card Scheme 2025

The Asaan Card Scheme provides a user-friendly application process:

- Visit the official website: akc.punjab.gov.pk.

- Fill out the online form through the PITB portal.

- Upload required documents for digital verification.

- Pay the processing fee (PKR 500).

More Read:Asaan Karobar Finance Register Now

Benefits of the CM Punjab Asaan Karobar Loan Scheme

- Economic Growth: Promotes entrepreneurship, particularly in high-growth sectors.

- Employment Opportunities: Encourages small businesses to hire more employees, boosting job creation.

- Financial Independence: Offers a lifeline to budding entrepreneurs without the burden of interest.

- Women Empowerment: Potential to prioritize female tycoons for broad growth.

Conclusion

The CM Punjab Asaan Karobar Loan Scheme 2025 is a innovative creativity aimed at development economic development in Punjab. With its interest-free loans, simplified procedures, and robust financial support, the scheme is a golden chance for magnates to grasp their dreams. Hopeful business owners are fortified to apply and take gain of this radical program to achieve financial liberty and donate to Pakistan’s cheap.