Life Insurance Scheme

The government of Khyber Pakhtunkhwa (KP) has recently unveiled a life insurance scheme to provide financial security to its citizens, especially focusing on vulnerable parts of society. This inspiration, approved by the local government, is aimed at easing the economic lacks faced by families after the loss of their primary earners. Below, we will cover all aspects of the scheme, counting eligibility criteria, required documents, the application process, and frequently asked questions.

More Read:Ehsaas Apna Ghar Scheme

Quick Overview of the Scheme

| Feature | Details |

| Program Name | KP Life Insurance Scheme |

| Start Date | December 2024 |

| End Date | Ongoing (long-term welfare program) |

| Assistance Amount | Up to Rs. 1 million depending on the deceased’s age |

| Application Method | Both online and offline options (provincial offices and digital portals) |

Key Features of the KP Life Insurance Scheme

- Financial Support: Provides financial help of Rs. 1 million for families of late members below 60 years and Rs. 500,000 for families of those above 60 years.

- Focus on Vulnerable Groups: Targets households below the poverty line, aiming to address the economic challenges faced after the loss of a breadwinner.

- Provincial Milestone: This creativity is part of KP’s broader welfare goals to found a safety net for its citizens.

Eligibility Criteria

To benefit from this scheme, applicants must meet the following criteria:

More Read:Benazir Kafaalat Program

- Residency: Must be a lasting resident of Khyber Pakhtunkhwa.

- Income Level: Favorite is given to families living below the poverty line.

- Deceased’s Details:

- Age: The deceased family member should have been either under 60 years for the higher payout or over 60 for the standard payout.

- Role: Must have been the primary earner in the household.

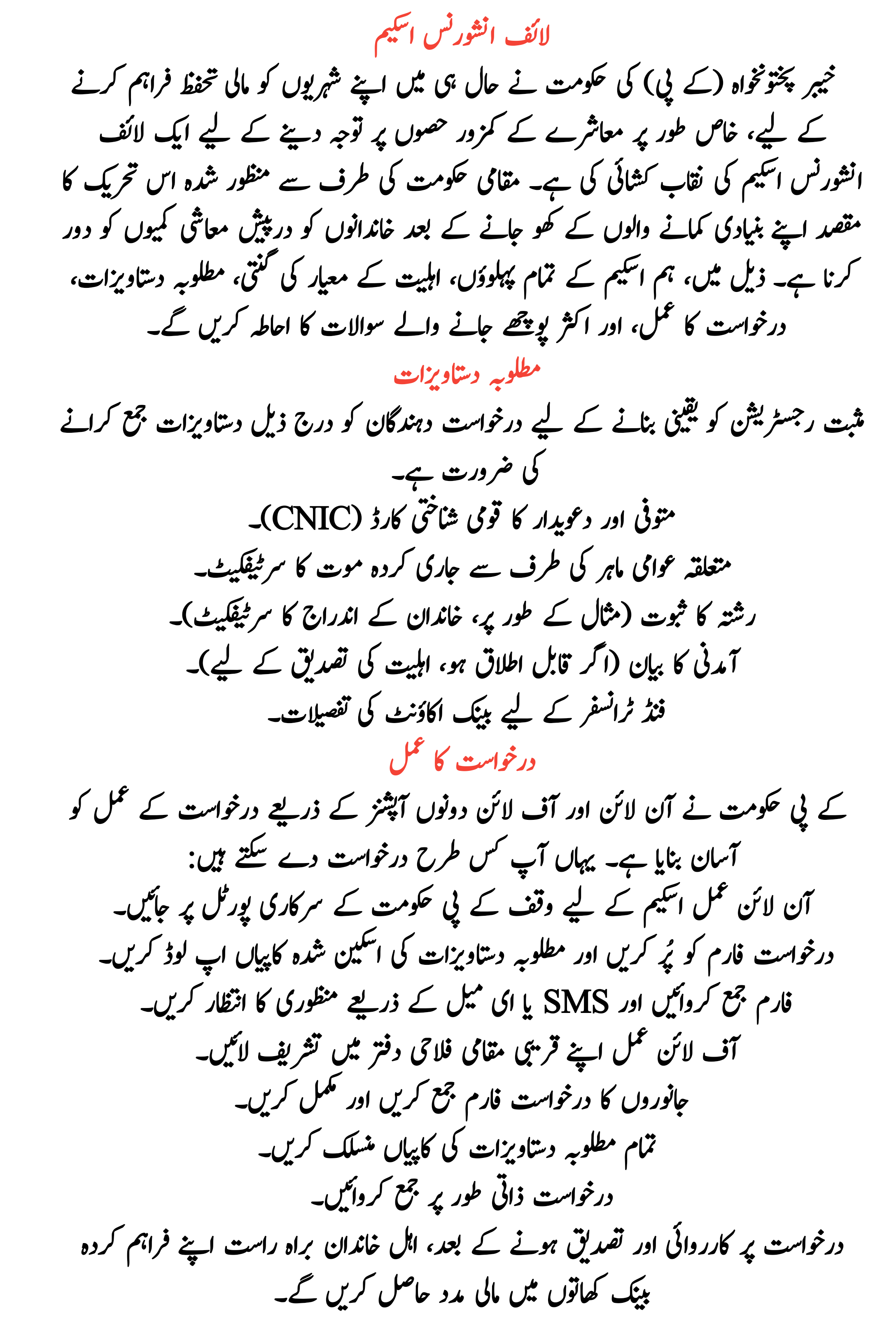

Required Documents

Applicants need to submit the following documents to ensure positive registration:

- National Identity Card (CNIC) of the deceased and the claimant.

- Death Certificate issued by the relevant public expert.

- Proof of Relationship (e.g., family registration certificate).

- Income Statement (if applicable, to confirm eligibility).

- Bank Account Details for fund transfer.

Application Process

The KP government has facilitated the application process by if both online and offline options. Here’s how you can apply:

Online Process

- Visit the official KP government portal dedicated to the scheme.

- Fill out the application form and upload scanned copies of the required documents.

- Submit the form and await approval via SMS or email.

Offline Process

- Visit your nearest local welfare office.

- Collect and complete the animal application form.

- Attach copies of all required documents.

- Submit the application in person.

Once the application is processed and verified, eligible families will receive financial support directly into their providing bank accounts.

More Read:Housing Scheme for Low-Income Families

Frequently Asked Questions (FAQs)

Who can apply for this scheme?

Any family who has lost a primary earning member and resides in Khyber Pakhtunkhwa can apply, provided they meet the eligibility criteria.

Is this a one-time payment?

Yes, the scheme provides a single payout per dead family member.

Can urban and rural residents apply equally?

Yes, the scheme is open to all KP citizens regardless of whether they live in urban or rural areas.

What is the timeline for receiving assistance?

Once the application is verified, financial assistance is classically paid within 30 days.

More Read:The Ehsaas Program

Can applications be submitted posthumously for deaths prior to the scheme’s announcement?

No, the scheme only covers deaths arising after its official launch.

Conclusion

The KP Life Insurance Scheme is a important step toward house a welfare-oriented society, shiny the government’s commitment to backup its citizens in times of crisis. By confirming financial security for families after the loss of a breadwinner, the initiative not only allays immediate hardships but also donates to long-term stability. With its straightforward application process and complete criteria, this scheme stands out as a beacon of hope for the underprivileged in Khyber Pakhtunkhwa.