Meezan Bank Apni Bike Scheme 2024

Meezan Bank, one of Pakistan’s important Islamic banks, has introduced the Meezan Bank Apni Bike Scheme 2024. This initiative aims to help people buy their dream bike through easy and Shariah-compliant part plans. The scheme is designed to provide financial help to a wide range of persons, including salaried employees, business owners, and self-employed experts. In this article, we will cover the portion plans, application process, eligibility criteria, benefits, and all essential details about this scheme.

More Read:Punjab Honhaar Scholarships Announce 60% Quota for Girls

Quick Information Table

| Program Name | Meezan Bank Apni Bike Scheme 2024 |

| Assistance Amount | Up to 100% Financing for Motorbikes |

| Eligibility | Salaried, Business Owners, Self-employed |

| Application Method | Online and Offline |

| Financing Tenure | 1 to 3 Years |

| Bank | Meezan Bank |

What is the Meezan Bank Apni Bike Scheme?

The Meezan Bank Apni Bike Scheme is a motorcycle backing program launched to help persons purchase motorbikes in easy payments. The financing is offered under Shariah-compliant terms and follows the concept of Ijarah (leasing). This means that Meezan Bank owns the motorbike during the lease period, and ownership is moved to the customer after the completion of expenses.

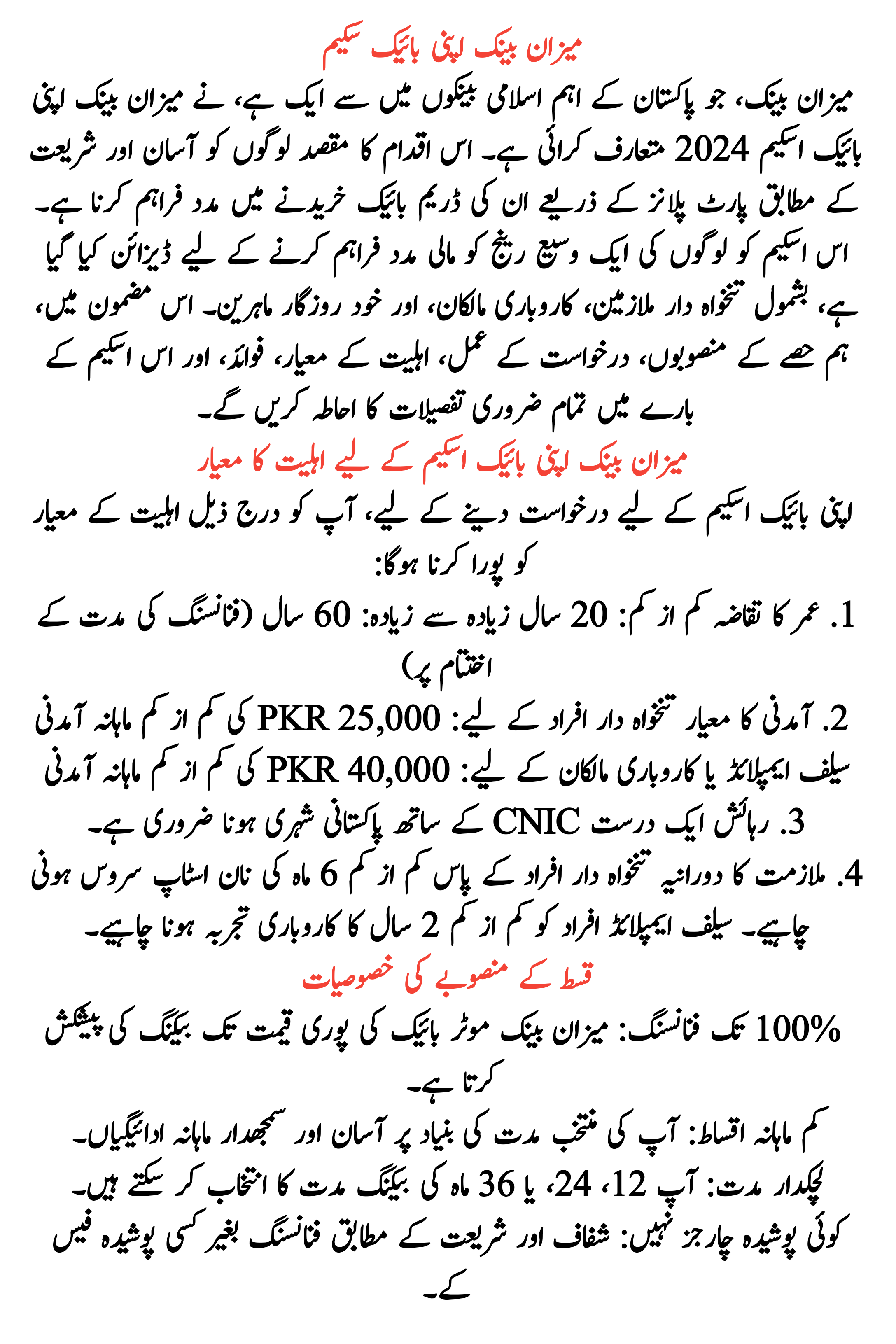

Eligibility Criteria for Meezan Bank Apni Bike Scheme

To apply for the Apni Bike Scheme, you must meet the following eligibility criteria:

1. Age Requirement

- Minimum: 20 years

- Maximum: 60 years (at the end of the financing period)

2. Income Criteria

- For Salaried Individuals: Minimum monthly income of PKR 25,000

- For Self-Employed or Business Owners: Minimum monthly income of PKR 40,000

3. Residency

- Must be a Pakistani citizen with a valid CNIC.

4. Employment Duration

- Salaried persons must have at least 6 months of nonstop service.

- Self-employed persons must have at least 2 years of business experience.

More Read:Over 26 Lakh Women Acquiring Support From 8171 Nashonuma Program

Installment Plan Details

Meezan Bank offers flexible installment plans to house different financial needs. The payment tenure ranges from 1 to 3 years.

Features of the Installment Plan

- Up to 100% Financing: Meezan Bank offers backing for up to the entire cost of the motorbike.

- Low Monthly Installments: Easy and sensible monthly payments based on your chosen tenure.

- Flexible Tenure: You can choose a backing period of 12, 24, or 36 months.

- No Hidden Charges: Transparent and Shariah-compliant financing with no hidden fees.

Example of Installment Plans

| Bike Price | 1 Year Plan (12 months) | 2 Year Plan (24 months) | 3 Year Plan (36 months) |

| PKR 150,000 | PKR 13,500/month | PKR 7,200/month | PKR 5,000/month |

| PKR 200,000 | PKR 18,000/month | PKR 9,600/month | PKR 7,000/month |

More Read:CM Maryam Launches School Nutrition Programme from DG Khan

How to Apply for Meezan Bank Apni Bike Scheme 2024

Meezan Bank has made the application process simple and user-friendly. You can apply through two methods: Online or Offline.

Online Application Process

- Visit Meezan Bank’s Official Website

Go to the Meezan Bank website and pilot to the Apni Bike Scheme - Fill Out the Application Form

-

- Provide your CNIC number, name, contact details, and income information.

- Select your preferred bike model and part plan.

- Upload Documents

-

- Upload necessary documents such as copy of your CNIC, salary slips (for salaried individuals), or business income proof (for self-employed).

- Submit the Form

Once the form is filled and documents are uploaded, submit your application. - Approval Notification

You will receive a confirmation SMS or email about the status of your application.

Offline Application Process

- Visit a Meezan Bank Branch

Go to your nearest Meezan Bank branch. - Request an Application Form

Ask for the Apni Bike Scheme application form. - Fill Out the Form and Submit Documents

-

- Complete the form and attach required documents like CNIC copy, salary slip, or business income proof.

- Submit the Form

Submit the filled form to the bank representative. - Approval Process

The bank will review your application and notify you of the support.

More Read:Benazir Income Support Program to Open Bank Accounts for All Beneficiaries

Required Documents for Application

- Copy of CNIC

- Recent Passport-Sized Photographs

- Salary Slip (for salaried individuals)

- Bank Statements (Last 6 Months)

- Proof of Business Income (for self-employed individuals)

Benefits of Meezan Bank Apni Bike Program

1. Shariah-Compliant Financing

The scheme follows Islamic banking principles, making it suitable for those who prefer interest-free options.

2. Flexible Installment Plans

Choose a repayment tenure that fits your budget.

3. Quick Approval Process

Fast processing and approval for eligible applicants.

4. Wide Range of Motorbikes

Financing available for popular bike brands like Honda, Suzuki, Yamaha, and others.

5. Convenient Application

Apply online or offline, making the process accessible for everyone.

More Read:Punjab Schools Ban Mobile Phones for Students and Teachers

FAQs About Meezan Bank Apni Bike Program

What is the minimum income requirement?

- PKR 25,000 for salaried individuals.

- PKR 40,000 for self-employed individuals.

Can I apply online for the scheme?

Yes, you can apply through Meezan Bank’s official website.

What is the financing tenure?

Financing is available for 1, 2, or 3 years.

Is this scheme Shariah-compliant?

Yes, it follows the Islamic concept of Ijarah (leasing).

Which bikes can I finance through this scheme?

You can finance popular brands like Honda, Suzuki, and Yamaha.

Conclusion

The Meezan Bank Apni Bike Program 2024 offers a bizarre opportunity for persons to own a bike through easy and affordable installment plans. With its Shariah-compliant financing, quick approval process, and supple tenures, this scheme makes motorbike ownership accessible to many Pakistanis. Whether you are a salaried employee, a business owner, or self-employed, you can benefit from this program and enjoy hassle-free carriage.