Punjab Asaan Karobar Scheme

The local government of Punjab has hurled the Asaan Karobar Scheme, a important initiative to support small and medium enterprises (SMEs). This scheme offers zero-interest loans to help entrepreneurs start or grow their trades, update processes, and even invest in sustainable projects. Designed to authorize the business public, the program aims to create a blooming economic setting in Punjab. Below, you’ll find all the info you need to appreciate and apply for these loans.

More Read:KPK Solar Scheme Application Form

Quick Information Table

| Field | Details |

| Name of Program | Punjab Asaan Karobar Scheme |

| Start Date | January 2025 (tentative) |

| End Date | Ongoing |

| Loan Amount | Rs. 1 million – Rs. 30 million |

| Assistance Type | Zero-interest loan |

| Application Method | Online |

| Processing Fee | Rs. 5,000 (Tier 1) / Rs. 10,000 (Tier 2) |

| Repayment | Equal monthly installments |

| Eligibility Criteria | Active tax filer, resident of Punjab, business-related documentation |

Understanding the Loan Tiers and Features

The Asaan Karobar Scheme delivers two tiers of loans, tailored to meet the diverse needs of entrepreneurs and SMEs. Below is a detailed breakdown:

Tier 1:

- Loan Range: Rs. 1 million to Rs. 5 million

- Eligibility: Requires a personal guarantee.

- Interest Rate: 0% (Interest-free)

- Repayment Period: Up to five years.

- Processing Fee: Rs. 5,000 (non-refundable).

Tier 2:

- Loan Range: Rs. 6 million to Rs. 30 million

- Eligibility: Requires secured collateral.

- Interest Rate: 0% (Interest-free)

- Repayment Period: Up to five years.

- Processing Fee: Rs. 10,000 (non-refundable).

In both tiers, payments must be made in equal monthly installments. Late payments incur a nominal penalty of PKR 1 per PKR 1,000 overdue.

More Read:Maryam Nawaz Negahban Program Registration

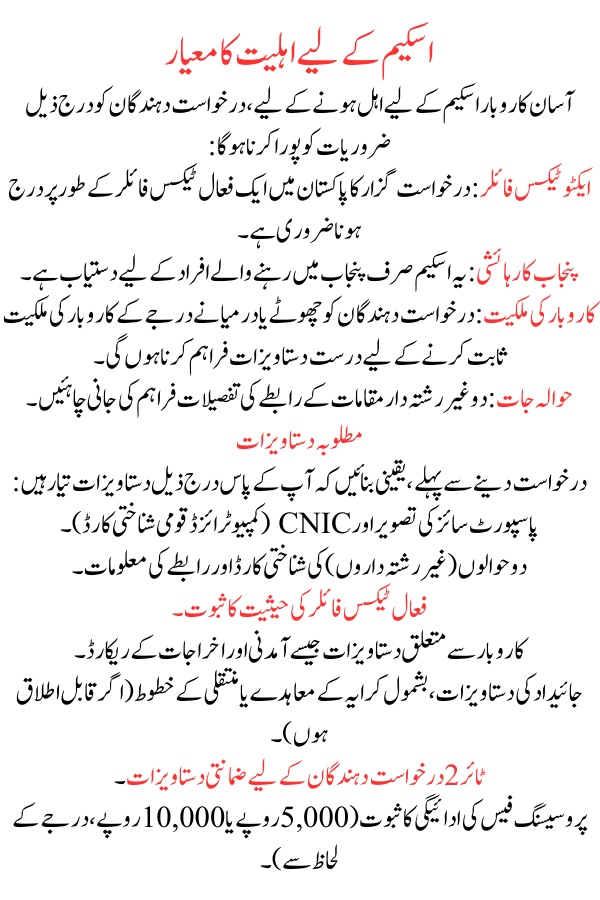

Eligibility Criteria for the Scheme

To qualify for the Asaan Karobar Scheme, applicants must meet the following requirements:

- Active Tax Filer: The applicant must be listed as an active tax filer in Pakistan.

- Resident of Punjab: This scheme is only available to individuals residing in Punjab.

- Business Ownership: The applicant must provide valid documentation to prove possession of a small or medium enterprise.

- References: Contact details of two non-relative loci must be provided.

Required Documents

Before applying, ensure you have the following documents ready:

- Passport-sized photograph and CNIC (Computerized National Identity Card).

- CNICs and contact information of two references (non-relatives).

- Proof of active tax filer status.

- Business-related documents such as income and expense records.

- Property documents, including rental agreements or transfer letters (if applicable).

- Collateral documents for Tier 2 applicants.

- Proof of payment for the processing fee (Rs. 5,000 or Rs. 10,000, depending on the tier).

More Read:Benazir Kafalaat Revalidation Extra Payment

Step-by-Step Application Process

Follow these steps to apply for a loan under the Asaan Karobar Scheme:

1. Register Online

Visit the official website of the Punjab Asaan Karobar Scheme. Create an version by if your email address, CNIC, and a valid phone number.

2. Fill Out the Application Form

Complete the online application form. The form needs basic details about your private and business background.

3. Upload Required Documents

Upload the necessary documents, including your CNIC, references, and business-related papers. Ensure all documents are in the correct format.

4. Pay the Processing Fee

Deposit the non-refundable dispensation fee of Rs. 5,000 (Tier 1) or Rs. 10,000 (Tier 2) through the designated payment method.

5. Submit the Application

After finishing all steps, submit your application. You will receive a registration number via SMS and email.

6. Track Your Application

You can track your application status through the online stand. Updates will also be shared via SMS.

7. Loan Approval

Once your application is studied and approved, you will receive a notice. The loan amount will be paid to your provided bank account.

Key Benefits of the Asaan Karobar Scheme

The Punjab Asaan Karobar scheme offers several advantages:

- Zero-Interest Loans: Helps reduce financial burden for startups and small trades.

- Flexible Loan Options: Two tiers of loans designed to meet different business supplies.

- Streamlined Process: An online platform ensures a quick and see-through application process.

- Support for SMEs: Encourages growth, transformation, and sustainability in Punjab’s business sector.

More Read:Benazir Kafalat Program 13500 Payment

Frequently Asked Questions (FAQs)

Who can apply for this scheme?

Anyone residing in Punjab and meeting the eligibility criteria, such as being an active tax filer and owning a business, can apply.

How long does the application process take?

Once all documents are submitted, the review process typically takes 2-3 weeks.

Is collateral mandatory for all loans?

Collateral is only required for Tier 2 loans (Rs. 6 million to Rs. 30 million).

Can I reapply if my application is rejected?

Yes, applicants can reapply after speaking the reasons for rejection.

Conclusion

The Punjab Asaan Karobar Scheme is a game-changing originality for SMEs and magnates in Punjab. By offering zero-interest loans and a frank application process, it aims to empower local businesses and rouse fiscal growth. If you meet the eligibility criteria and are looking for financial assistance to start or expand your business, this scheme is an excellent chance. Apply today and take the first step towards reaching your business goals!